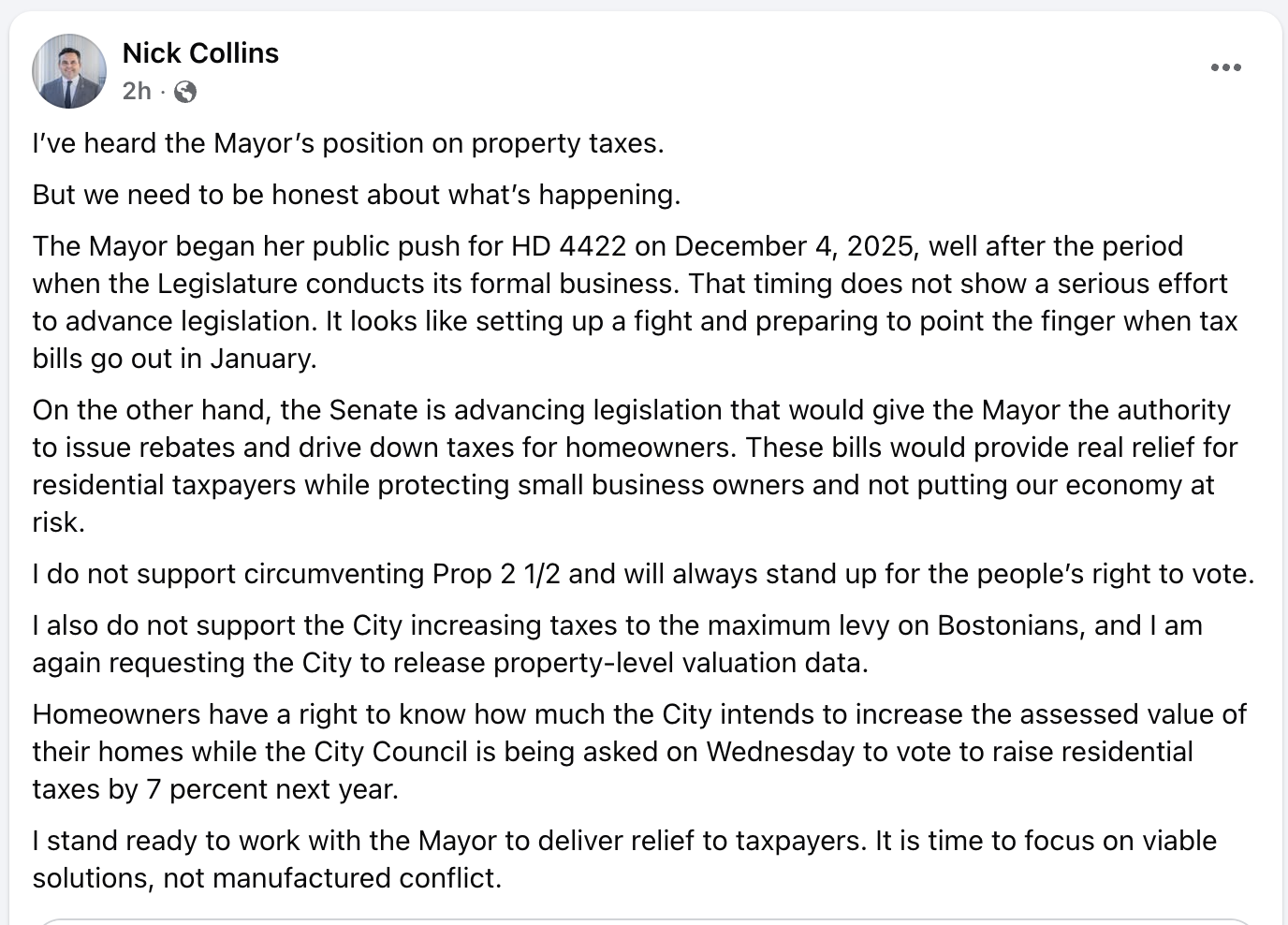

Collins said he has “heard the Mayor’s position on property taxes,” but argued that homeowners deserve clarity about how the city reached its current position — and what options remain on the table.

Timing of the proposal

In his post, Collins highlighted the timing of Wu’s public push for special tax legislation, noting that it began on December 4, well after the Legislature’s primary period for formal business had concluded.

“That timing does not show a serious effort to advance legislation,” Collins wrote.

Collins framed the late push as a strategic move rather than a procedural necessity, suggesting it places lawmakers under pressure while setting the stage for blame if higher tax bills arrive in January. City Hall, by contrast, has argued that urgency is required to address shifting tax burdens and prevent deeper increases in future years.

How the mayor’s proposal works

Wu’s proposal would adjust Boston’s property tax rates through special legislation rather than through a voter ballot question. Under the plan, Beacon Hill would set higher tax rates and a larger residential tax shift by statute.

That process would not include a public vote.

The proposal also contains language allowing for possible rebates. A review of the bill shows those rebates would only become an option if the tax-rate increase itself does not take effect. Even then, any rebate would be limited, subject to City Hall approvals, and dependent on strict financial conditions.

MASSDAILYNEWS

STAY UPDATED

Get Mass Daily News delivered to your inbox

The rebate alternative

Collins contrasted the mayor’s approach with Senate-backed legislation he has promoted in earlier Facebook posts. Those measures — S.1933 and S.1935 — would authorize Boston to issue cash rebates to homeowners using available surplus and reserve funds.“These bills would provide real relief for residential taxpayers while protecting small business owners and not putting our economy at risk,” Collins wrote.

Collins argues that rebate authority would allow the city to deliver taxpayer relief without first increasing rates or bypassing voter approval.

Voter approval as a dividing line

Collins also emphasized what he described as a core disagreement over governance.

“I do not support circumventing Prop 2½ and will always stand up for the people’s right to vote,” he wrote, adding that he opposes pushing Boston to the maximum allowable tax levy.

Under Proposition 2½, voters retain direct approval over certain property tax increases. Wu has said greater flexibility is needed to manage long-term fiscal pressures, while Collins maintains that voter approval remains a critical safeguard.

Requests for disclosure

Collins renewed his call for the city to release property-level valuation data before any vote on higher taxes, saying homeowners should understand how assessed values are expected to change.

That request comes as the City Council prepares to vote on a proposed 7 percent residential tax increase.

“Homeowners have a right to know how much the City intends to increase the assessed value of their homes,” Collins wrote.

Competing approaches

While Collins said he is willing to work with the mayor, he cautioned against what he described as manufactured conflict.

“I stand ready to work with the Mayor to deliver relief to taxpayers,” he wrote. “It is time to focus on viable solutions, not manufactured conflict.”

The disagreement highlights two competing approaches now unfolding at City Hall and Beacon Hill: one that relies on legislated tax-rate changes to address fiscal pressures, and another that prioritizes rebates, data disclosure, and voter approval.

For homeowners watching property tax bills rise, the outcome of that debate may determine whether relief comes through higher rates set by law — or through direct rebates coupled with greater transparency.

Loading Comments